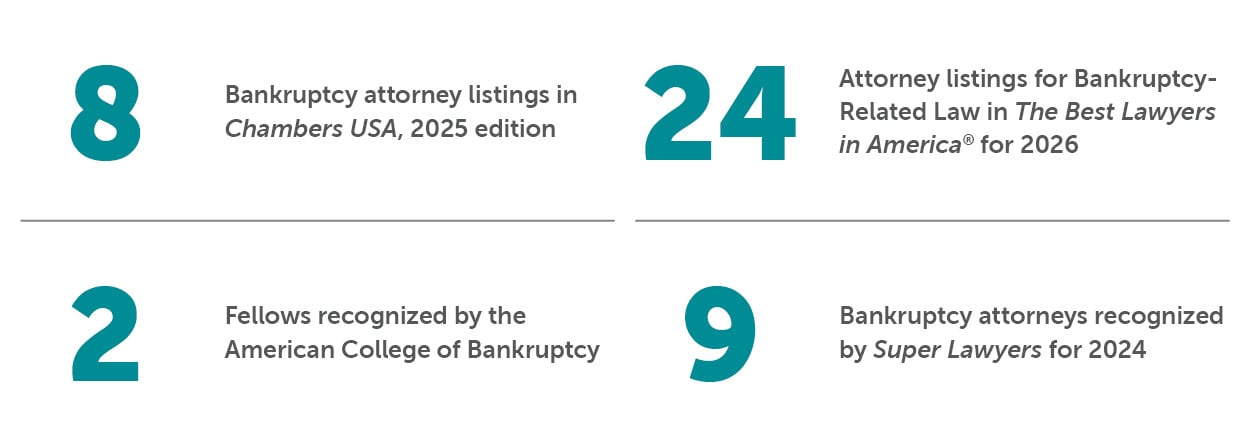

Our litigators have significant trial experience in complex bankruptcy litigation and a consistent record of settling large cases on attractive terms. We frequently defend clients against claims brought by Chapter 7 trustees and Chapter 11 debtors. The group also handles: